Trading apps have changed how India invests and trades. With millions of new users joining, choosing the right platform is the first crucial step to success. This guide reviews the best trading platform in India for 2025.

We deeply analyzed India’s leading stockbrokers. Our review focuses on cost, technology, features, and user experience for all investor types.

I. Comparison Table: Best Trading Apps in India 2025

| Rank | Trading App | Best For | Equity Delivery Fee | Intraday & F&O Fee | Active Clients (Oct 2024)* |

|---|---|---|---|---|---|

| 1 | Groww | Beginners & Long-Term Investors | ₹0 | Flat ₹20 per order | 12.59 Million |

| 2 | Zerodha Kite | Experienced Traders & Algo Users | ₹0 | Flat ₹20 per order | 8.07 Million |

| 3 | Angel One | Full-Service & Advisory | ₹0 | Flat ₹20 per order | 7.53 Million |

| 4 | Upstox Pro | Budget-Conscious & Mobile Trading | ₹0 | Flat ₹20 per order | 2.85 Million |

| 5 | Shoonya by Finvasia | Zero Brokerage Across Segments | ₹0 | ₹0 | 165K+ |

| 6 | Paytm Money | Mutual Funds & Digital First | ₹0 | Flat ₹15 per order | (Top 10 Player) |

| 7 | ICICI Direct | Integrated Banking (3-in-1 Account) | Varies | Flat ₹20/order | 1.93 Million |

| 8 | mStock (Mirae Asset) | Low Brokerage, High Leverage | ₹0 | Flat ₹5-₹20 per order | (Growing Rapidly) |

| 9 | Dhan | Traders Needing Advanced Tools | ₹0 | Flat ₹20 per order | (Modern Platform) |

| 10 | Flattrade | True Zero-Brokerage Model | ₹0 | ₹0 | 500K+ Downloads |

*Source for Active Clients (Groww, Zerodha, Angel One, Upstox, ICICI Direct): Efiletax, Oct 2024 Data.

II. Detailed Reviews of the Top 5 Trading Apps

1. Groww: The No 1 Trading App in India for New Users

Groww has rapidly taken the lead in market share. Its success comes from its extremely simple, user-friendly interface. It is the perfect choice for first-time investors looking for an easy start.

This app is popular for its paperless KYC and quick account setup. Groww allows you to invest in stocks, mutual funds, ETFs, and IPOs all from one place.

Key Features & Fees

- Best For: Beginners, SIP investors, and mutual fund buyers.

- Zero Brokerage: Equity delivery and direct mutual funds are free.

- Ease of Use: Recognized for its clean UI and excellent educational resources.

- Market Leadership Fact: Groww holds the largest active client market share in India (26.16% as of October 2024).

2. Zerodha Kite: The Powerhouse for Experienced Traders

Zerodha, with its platform ‘Kite,’ pioneered the discount broking model in India. It is preferred by active traders and those who need advanced charting. Zerodha is known for its reliability and robust technology.

The platform provides advanced tools like Bracket Orders, Cover Orders, and free APIs. These features support sophisticated strategies and algo trading.

Key Features & Fees

- Best For: Active traders, F&O participants, and developers.

- Zero Brokerage: Free equity delivery trades.

- Technology: Kite is stable, fast, and features advanced TradingView charts.

- Trust Fact: Zerodha is trusted with over ₹6 lakh crores in equity investments from its customers.

3. Angel One: The Hybrid of Discount and Full Service

Angel One offers a good balance between a low-cost structure and full-service advisory support. This makes it a great choice for best trading platform in India for beginners who might need guidance. They provide advisory calls and detailed research reports.

The app, formerly known as Angel Broking, has invested heavily in technology. Its fast execution and simple UI appeal to a large, diverse user base.

Key Features & Fees

- Best For: Beginners who want research tips, and those needing margin facility.

- Zero Brokerage: Free equity delivery.

- Support: Access to a strong research team and advisory services.

- Unique Feature: Offers margin trading facility (MTF) to amplify potential returns.

4. Upstox Pro: Speed and Simple Mobile Trading

Upstox is a high-growth discount broker, backed by prominent global investors. It is known for its lightning-fast execution speed on the mobile app. Upstox Pro is popular among younger, mobile-first traders.

The platform includes over 100 technical indicators and is easy to navigate. It is designed to maximize trading efficiency on the go.

Key Features & Fees

- Best For: Mobile traders and budget-conscious investors.

- Zero Brokerage: Free equity delivery.

- Technology: HTML-based web platform and a clean, fast mobile app.

- LSI Keyword: A top contender for the top stock trading apps in india list.

5. Shoonya by Finvasia: True Zero Brokerage

Shoonya by Finvasia stands out by offering zero brokerage across almost all segments. This includes Equity Delivery, Intraday, F&O, and Currency. This can save high-volume traders significant money.

There are no charges for account opening, AMC (Annual Maintenance Charges), or even call & trade. This transparent model is ideal for high-frequency or budget-sensitive traders.

Key Features & Fees

- Best For: High-volume traders and cost-sensitive investors.

- Zero Brokerage: Absolutely ₹0 brokerage on all trades (Delivery, Intraday, F&O).

- Transparency: No hidden charges for account opening or maintenance.

- User Base Fact: Serves over 165,164 active users, prioritizing cost-effective structure.

III. Essential Guide for Choosing Your Trading App

When you choose a trading app, you should look past the marketing. Focus on these four critical factors that affect your trading success and safety.

1. Brokerage Fees and Charges

The fee structure is the most important factor for an active trader. Even a ₹20 charge per trade can add up quickly over time.

- Equity Delivery: Many platforms now offer ₹0 delivery fees. This is standard for long-term investments.

- Intraday/F&O: Most charge a flat fee (e.g., ₹20 per trade). Look for zero brokerage trading app options like Shoonya or Flattrade to maximize savings.

- Hidden Fees: Always check for DP charges, Annual Maintenance Charges (AMC), and payment gateway fees.

2. Technology and Execution Speed

A platform must be fast, stable, and reliable. Slow execution can cost you money during volatile market movements.

Look for apps that offer:

- Advanced Charting: Integration with tools like TradingView.

- Order Types: Availability of GTT (Good Till Trigger), Bracket, and Cover Orders.

- APIs: Free or paid access for those interested in algorithmic trading.

3. Safety, Security, and Compliance (E-E-A-T)

The safety of your funds is non-negotiable. Always verify that the broker is registered with SEBI (Securities and Exchange Board of India).

- Regulatory Fact: SEBI recently introduced “Validated UPI handles” for securities transactions. This helps investors instantly verify if the bank account belongs to a genuine, regulated intermediary.

- Fund Protection: SEBI also requires brokers to upstream all client funds to clearing corporations, protecting them from misuse.

4. Account Opening & User Experience (Beginners)

For beginners, the platform must be intuitive. A confusing interface leads to mistakes and lost opportunities.

- Look for apps like Groww that are known for their clean, simple design.

- Check if the app provides educational content, like Zerodha’s Varsity, to help you learn as you trade.

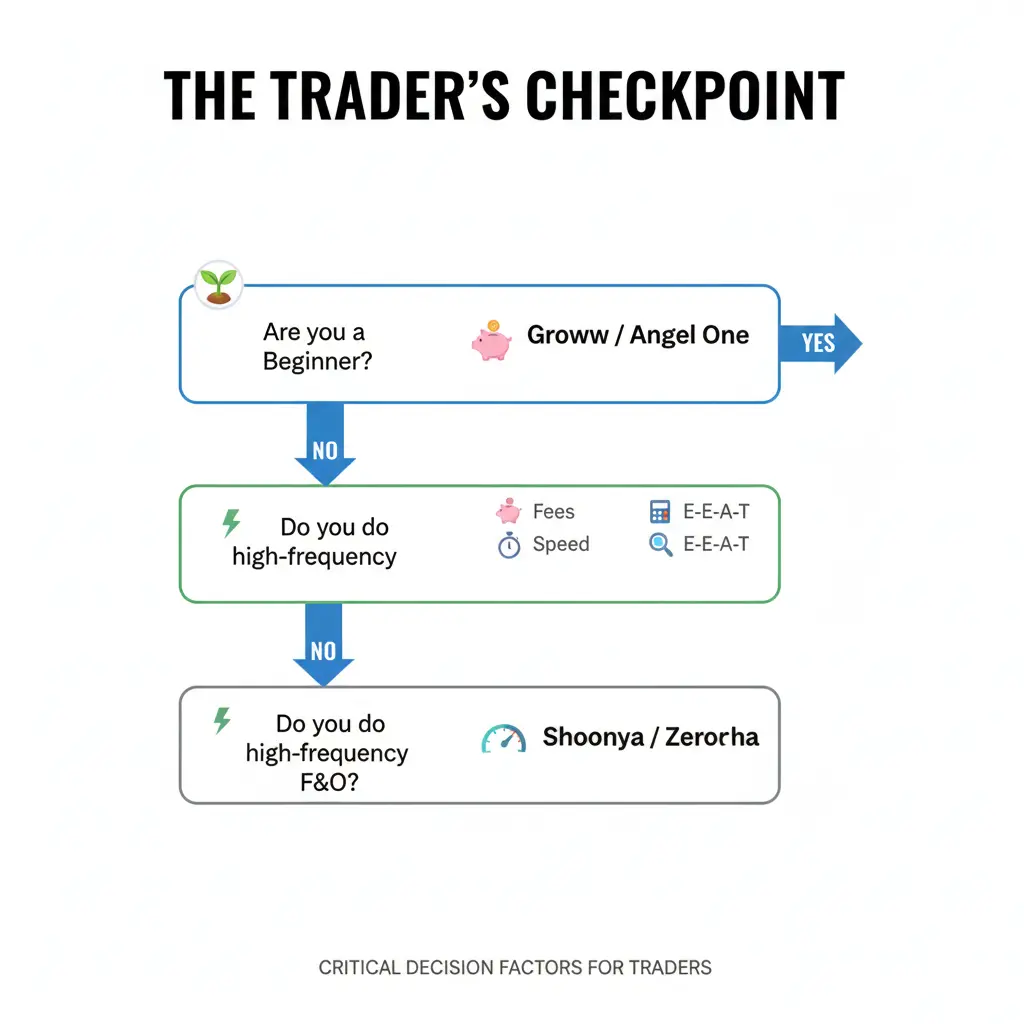

IV. Visuals and Infographic Content Ideas

1. The Trader’s Checkpoint

2. SEBI Security Shield

V. Frequently Asked Questions (FAQs)

We answer the most common questions about finding the best trading app in India.

Q: Which is the No. 1 trading app in India based on user base?

A: As of the latest data (October 2024), Groww leads the market in terms of active clients on the National Stock Exchange (NSE). It has secured the No 1 trading app in India spot for its strong appeal to new, digital-first investors.

Q: What is the best trading app in India with zero brokerage?

A: Platforms like Shoonya by Finvasia and Flattrade offer true zero brokerage across segments, including Equity Delivery, Intraday, and F&O. Other major brokers like Groww and Zerodha offer zero brokerage only for Equity Delivery.

Q: Can I start trading in India without any investment?

A: You can open a demat and trading account for free (many brokers offer ₹0 account opening and AMC). However, to actually trade, you must deposit capital. Some apps offer virtual trading or paper trading features to practice without real money.

Q: Which trading app is best for beginners in India?

A: Groww and Angel One are widely recommended for beginners. Groww offers the cleanest user interface, making navigation easy. Angel One provides helpful research and advisory reports, which can guide a new investor.

Q: What are the new SEBI rules for retail algo trading?

A: SEBI has introduced a new framework for retail algorithmic (algo) trading. This requires brokers to get prior approval from stock exchanges for each algo strategy and mandates a unique identifier for every order for audit trail purposes (SEBI Circular, September 2025).

VI. About the Author

TANISHQ MITTAL

Freelance Trader

Tanishq mittal is a certified financial market analyst and a full-time professional trader with over 12 years of experience in the Indian equity, derivative, and commodity markets. He holds an MBA in Finance from [Top Indian University]. Tanishq’s passion is simplifying complex trading concepts and helping retail investors choose secure, effective, and low-cost platforms. His reviews are based on actual platform testing and deep analysis of market regulations.

Last Updated: October 5, 2025 Disclaimer: All investments in the securities market are subject to market risks. Read all related documents carefully before investing.